Ghana's Debt Crisis- Explained

Ghana’s reliance on borrowings to finance budget deficits was a key contributor to the default.

“Never, say never” is the story. Well, should we say, “it is insanity to repeat the same actions and expect different results”? How do you explain a country repeating the same mistake 17 times within 65 years of independence? This is the story of the second-largest producer of Cocoa in the world.

It is never out of place for a government to borrow money. It’s a vehicle for monetary and fiscal policy. Government borrowing comes in different formats. It could be through treasury bills, local bonds, Eurobonds, Sukuk, and a host of others. Loans are either external or internal, short or long. Typically, when the government borrows, it pays back an interest called a “coupon” payable at a specified period, and the principal is repaid at maturity. Do you know that financial institutions also lend to the government when they invest in government securities?

When a government bond is issued in the local currency, it is a “sovereign bond” and if it is issued in any other currency, it is called Eurobonds. It is a popular phrase in the world of financial management that government does not default on bonds, especially local ones. In the worst case, a government can print to pay its investors. Back to Ghana’s debt crisis, what really happened?

In January 2022, Bloomberg raised speculations about investors losing patience as Ghana’s debt moves deeper into distress. The Ministry of Finance debunked the claim Response to Bloomberg’s Article on Ghana’s Debt | Ministry of Finance | Ghana (mofep.gov.gh). 11 months later, Ghana declared a debt restructuring on all sovereign bonds which means they are unable to service their obligations to the investors. The government announced a cancellation of all bonds and restructured them into four new bonds due 2027, 2029, 2023, and 2037 at 0% in 2023, 5% in 2024, and 10% from 2025 until maturity. These bonds were earlier priced at a 15-18% coupon rate. Some bonds were offering as high as 25%. They are proposing new terms with cheaper rates. The next question is why did they call for debt restructuring?

The government borrowed more than it could pay. Ideally, when a government borrows money, it is used for value-yielding infrastructural projects but in this case, government spendings were on frivolous things. This government spending, among all these, led to a rise in the inflation rate to 40% in October 2022. The highest in two decades.

The currency has fallen by 40% alone this year. The worst for any country this year. State debt to GDP is currently 76% from 68% in 2017. Bloomberg reports that “Ghana is struggling with a currency that’s among the world’s worst performers. The weakening cedi has fueled inflation and drained foreign reserves. President Nana Akufo-Addo’s government is considering revamping part of its 190.3 billion cedis ($13.1 billion) of local debt, to win International Monetary Fund support for a loan of as much as $3 billion.” Ghana Budget: Debt Exchange Planned as Review Shows High Risk of Distress - Bloomberg

The Ghanaian government is proposing a 2.5% increase in Value Added Tax (VAT), 30% cut in public-servant salaries among all measures to save the economy. These measures will enable them to secure a $3 billion in funding from the International Monetary Fund (IMF) and improve their rating with Fitch.

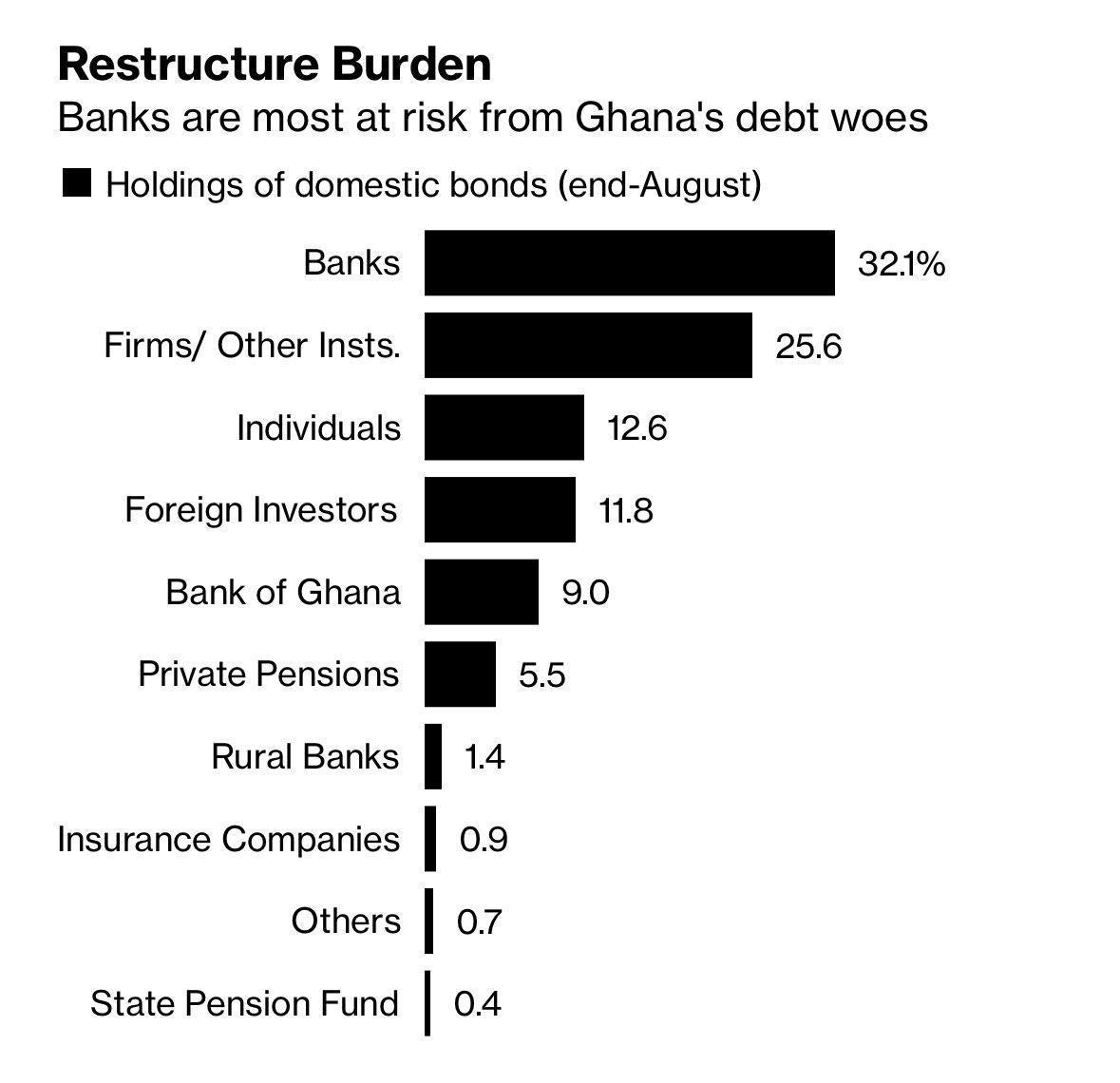

The resulting effects of the default and restructuring of the local debts, otherwise known as sovereign bonds, are the banks, pension, and other institutional investors who had subscribed to the bonds as the principal invested is tied and there is a haircut of 50% on the coupon rate (Haircut means a reduction in value).

When will Africa learn? Several African countries are close to facing a similar situation. Kenya defers Sh90bn payments on Eurobond miss - Business Daily (businessdailyafrica.com), Zambia default etc.

A system that glorifies borrowing will face a lot of challenges. Fiscal discipline is key to economic growth. Ghana’s reliance on borrowings to finance budget deficits was a key contributor to the default. I hope Nigeria is watching and taking note.

This is a messy situation that requires urgent and practical solutions. In the words of John Delaney, “An institution that borrows on a non-prioritized basis would never contemplate borrowing on a prioritized basis. Doing so would undermine its standing in the bond market and suggest that it is not worthy of its strong credit rating. This type of self-imposed downgrade would materially affect its financial prospects.”

I hope this helps. If you will the content useful, kindly share the link with others.

Cheers to a profitable lifestyle,

TL.

What does non-prioritized basis and prioritized basis mean?